Trading News

Follow along and use market news to help you make informed decisions on your investments. Discover rumors of a merger that could send share prices up, read about central bank policy shifts that will impact exchange rates, and more...

Follow along and use market news to help you make informed decisions on your investments. Discover rumors of a merger that could send share prices up, read about central bank policy shifts that will impact exchange rates, and more...

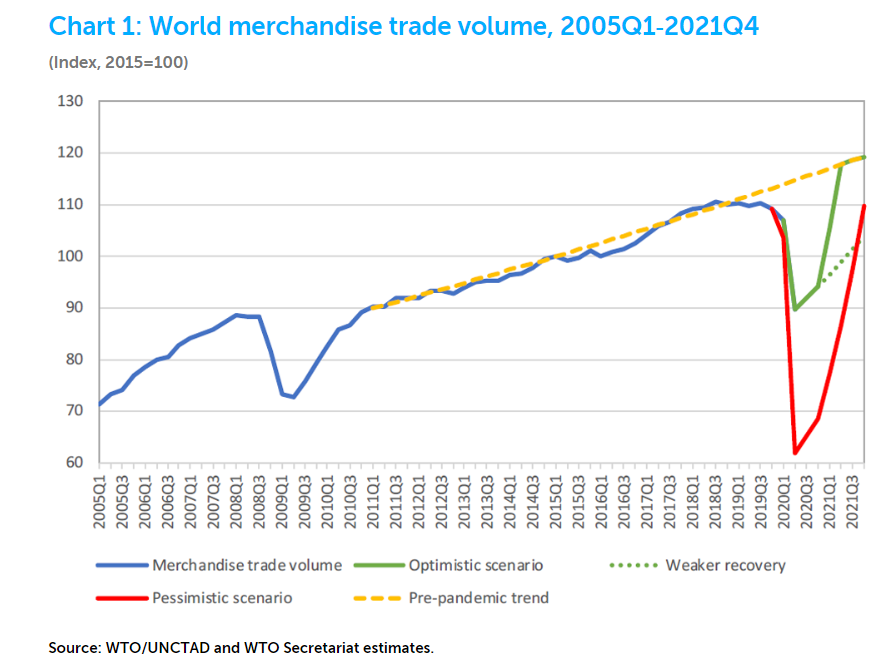

Manufacturing and services figures for October revealed a broad decline in performance across the EU, UK and US as inflation and rising interest rates take their toll on investment and consumption. Flash Purchasing Managers Index (PMI) Composite reports from S&P Global showed EU manufacturing at the level of 46.6 in October, while the services sector was at the level of 48.2. In the UK, the flash PMI for manufacturing in October was at the level of 45.8 and services fell to 47.5 from 50 previously. The US Global Composite flash PMI for October declined to the level of 47.3 from 49.5 the previous month.

In this article, you will read about the media’s role in market transparency and why it matters to traders and investors. The main points discussed are: what transparency means in the financial markets, how an asset’s financial history counts in research and analysis, the differences in transparency between mature and emerging markets. You might be surprised by the title of this blog, perhaps it seems disconnected from the day-to-day business of trading and investing. This could be because the role of the media is taken so much for granted it goes largely unnoticed. The news media is one of the strongest drivers of market dynamics and plays a weighty role in shaping and reporting financial changes in a plain and simple way for the layman to grasp their essential meanings.

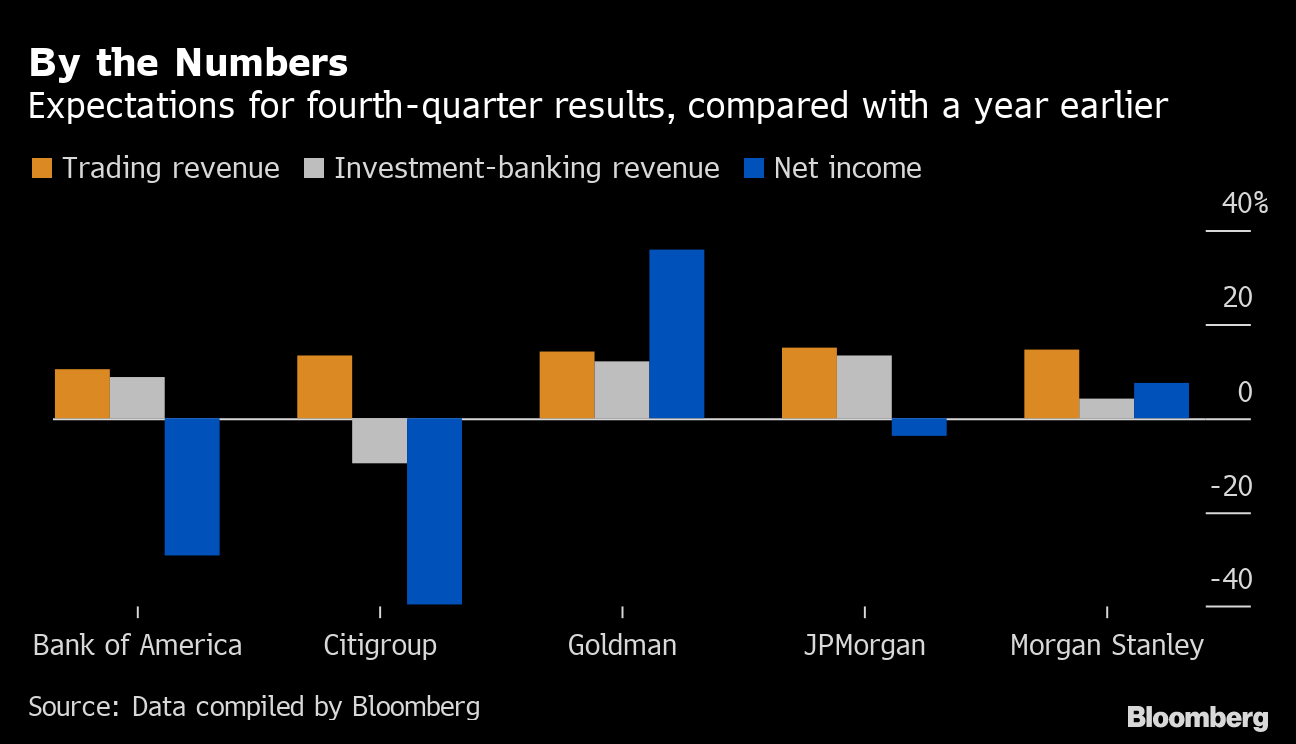

Earnings season is upon us once again and, kicking off the week on Monday, was Bank of America with their third quarter results. Despite closing last week down 29% for the year, the Bank of America share price soared more than 6% in the first session of the week, as Q3 earnings soundly beat expectations.

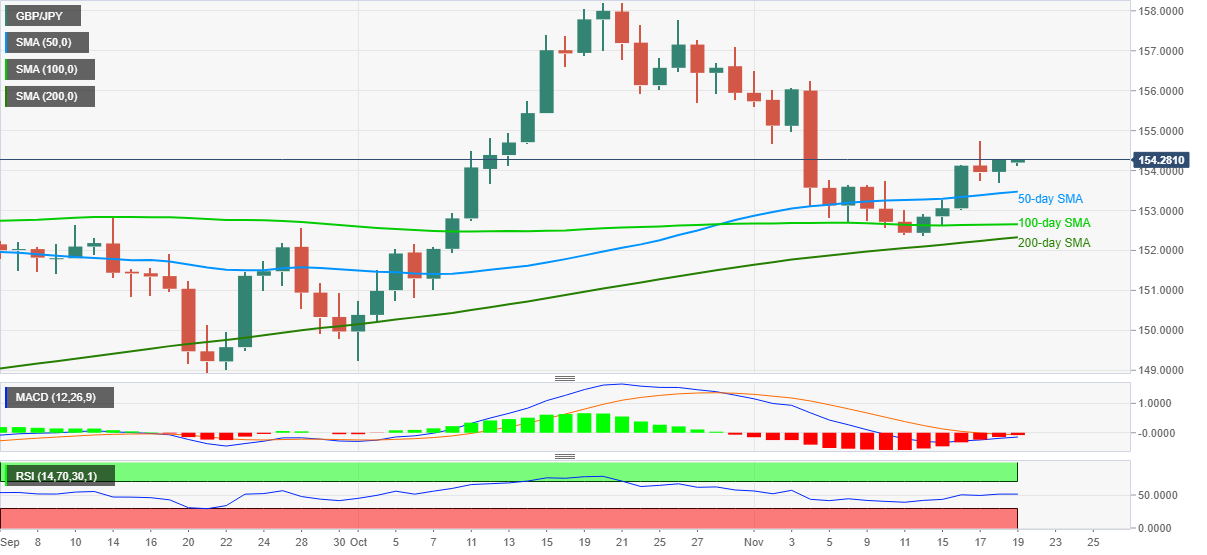

The GBP faces the heavyweight USD amid new inflation data released this morning. With the US Dollar at the highest level since 2000, the currency has fed into inflationary pressures in most countries. Since the beginning of 2022, the USD has appreciated by 22 percent against the Yen and 13 percent against the EUR because of interest rate hikes in the US, according to the International Monetary Fund (IMF). For each 10 percent the USD rises against a currency, it adds around 1 percent to the inflation rate, said the IMF. This is because 40 percent of world trade is denominated in US Dollars and approximately 50 percent of all cross-border loans and global debt securities are in USD.